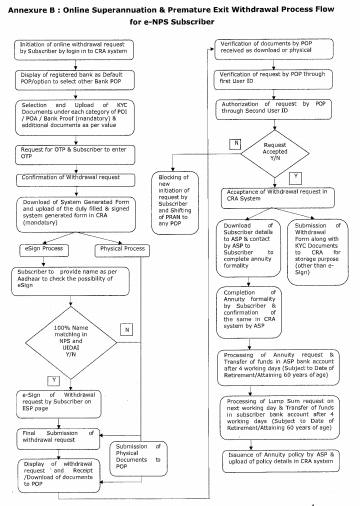

Online Superannuation & Premature Exit Withdrawal Process Flow

for e-NPS Subscriber

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

13-14/A, Chhatrapati Shivaji Bhawan, Qutub Institutional Area,

Katwaria Sarai, New Delhi-110016

Ph: 011-26517501, 26517503, 26133730 Fax: 011-26517507

Website: www.pfrda.org.in

13-14/A, Chhatrapati Shivaji Bhawan, Qutub Institutional Area,

Katwaria Sarai, New Delhi-110016

Ph: 011-26517501, 26517503, 26133730 Fax: 011-26517507

Website: www.pfrda.org.in

CIRCULAR

CIR No. : PFRDA/2020/18/SUP-CRA/7

Date: May 27, 2020

To,All stakeholders under National Pension System (NPS)

Subject: Additional Modes of e-NPS exit

eNPS offers ease of online opening of

NPS account in a paperless manner. Henceforth, it has been decided to

provide additional option to e-NPS subscribers to exit also from NPS through an online process.

This option of exit shall be applicable for both i.e. for pre-mature as

well as normal exit, in terms of provisions of the PFRDA (Exit and

Withdrawal under National Pension System) Regulations 2015. The process

would be implemented shortly.

2. Under the existing offline process,

the e-NPS subscriber has to approach the Bank-Point of Presence (POP) to

get his withdrawal request processed by shifting his NPS account

through Inter-Sector Shifting (ISS) from ‘e NPS’ to the ‘Bank- POP.

Thereafter the NPS withdrawal forms along with the specified documents

are required to be submitted to the Bank-POP for authorization, to

enable CRA to proceed with the exit process.

3. The proposed online process of e-NPS

exit would be akin to the existing online e NPS platform already in use

for opening NPS accounts by customers of Bank-POPS. In the proposed

online exit process, the KYC of e-NPS subscribers shall be verified by

the respective Bank POPs where these subscribers have their existing

banking relationship. Banks shall also be eligible for payment of

processing fees.

4. Central Record Keeping Agencies

(CRAs) have been advised to develop online ‘e NPS exit functionality’ in

co-ordination with Banks to facilitate the online process of exit of e

NPS subscribers who are also the customers of those Banks. The process

flow is provided at the Annexure A and B. The claims arising due to

death of NPS Subscribers shall be handled off line by NPS Trust.

5. This circular is issued in exercise

of powers conferred under section 14 of PFRDA. Act 2013 and is available

at PFRDA’s website (www.pfrda.org.in) under the Regulatory framework

and in “Circular” sections of CRA, POPs and NPST under intermediaries.

(K Mohan Gandhi)

General Manager

General Manager

Annexure – A

e-NPS withdrawal process

A. Normal/Premature exit under e-NPS:

a. An option will be

available in the respective CRA website for the subscriber to submit

withdrawal request. For this purpose, limited access would be provided

on CRA Website to the subscriber to provide withdrawal request details

and upload scanned documents.

b. The subscriber

shall provide details of bank account, address etc. and upload scanned

copies of his KYC documents .and bank account proof.

c. The option of e-sign shall be provided to make the process paperless.

d. Once withdrawal

request is successfully submitted online by the subscriber with e-sign,

KYC documents shall be displayed online to Bank-POP for verification.

The verification of the documents would be done by the Subscriber’s

bank.

e. Once verified, the exit would be processed by the CRA.

B. Exit from e-NPS due to death:

a. The

nominee/claimants can also opt to submit the exit form to NPS Trust with

the required documents after verification of his KYC by his bank. The

nominee has to get a Bank’s KYC confirmation on bank’s letterhead

containing the photo and signature of the nominee.

b. The Bank’s letter

needs to be signed with seal by the designated bank official where the

nominee has the bank account and where the claimants would like to

receive the lump sum and/ or annuity and submit the same to NPS Trust.

c. Post receipt of duly verified documents in the manner as given in b.

above, NPS Trust will authorize the withdrawal request after due diligence and after satisfying themselves about the veracity of the claim.

above, NPS Trust will authorize the withdrawal request after due diligence and after satisfying themselves about the veracity of the claim.

d. Address of NPS Trust:

National Pension System Trust,

3i’d Floor, Chhatrapati Shivaji Bhawan,

_13-14/A, Qutab Institutional Area,

New Delhi —110016

3i’d Floor, Chhatrapati Shivaji Bhawan,

_13-14/A, Qutab Institutional Area,

New Delhi —110016

C. Fees for processing e NPS exits to Bank-POPs

Banks shall get a fee © 0.125% of the

total NPS corpus (Minimum amount of Rs.125/- and maximum Rs. 500/4 These

proposed charges to Bank— PoPs would be applicable for both

online/offline KYC verification process related to eNPS exits.

D. Important Information:

The above process of e NPS exits co-exist along with the existing modes of handling of e- NPS exits.

Signed copy