Download The Finance Bill of 2022 PDF

Finance Minister Nirmala Sitharaman’s presented her fourth budget today i.e. on 1st February 2022. In budget FM has introduced Tax on Virtual Currencies, Introduces no change in Tax Rate for Individuals, Provided relief on Surcharge on LTCG etc.

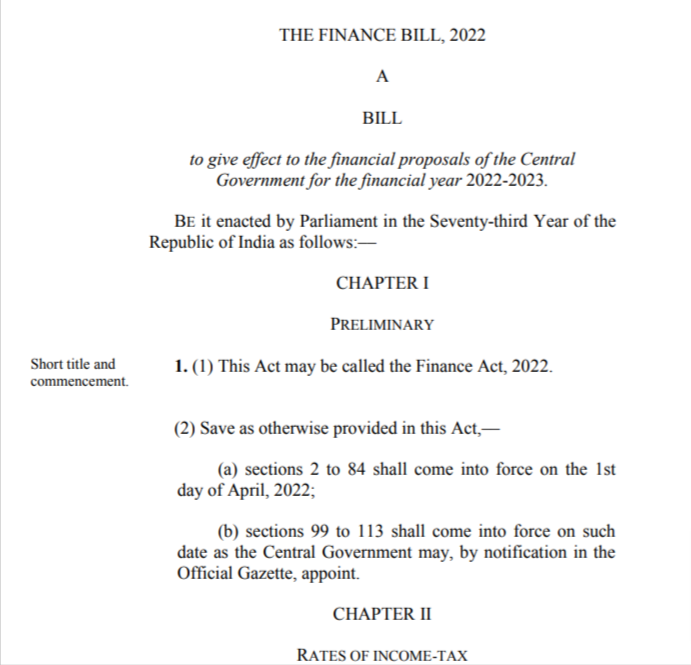

THE FINANCE BILL, 2022

A BILL to give effect to the financial proposals of the Central Government for the financial year 2022-2023. BE it enacted by Parliament in the Seventy-third Year of the Republic of India as follows:––

CHAPTER I

PRELIMINARY

1.This Act may be called the Finance Act, 2022.

2. Save as otherwise provided in this Act,

(a) sections 2 to 84 shall come into force on the 1st day of April, 2022;

(b)

sections 99 to 113 shall come into force on such date as the Central

Government may, by notification in the Official Gazette, appoint.

CHAPTER II

RATES OF INCOME-TAX

(1) Subject to the provisions of sub-sections (2) and (3), for the assessment year commencing on the 1st day of April, 2022, income-tax shall be charged at the rates specified Part I of the First Schedule and such tax shall be increased by a surcharge, for the purposes of the Union, calculated in each case in the manner provided therein.

(2) In the cases to which Paragraph A of Part I of the First Schedule applies, where the assessee has, in the previous year, any net agricultural income exceeding five thousand rupees, in addition to total income, and the total income exceeds two lakh fifty thousand rupees, then,—

(a) the net agricultural income shall be taken into account, in the manner provided in clause

(b) [that is to say, as if the net agricultural income were comprised in the total income after the first two lakh fifty thousand rupees of the total income but without being liable to tax], only for the purpose of charging income-tax in respect of the total income; and (b) the income-tax chargeable shall be calculated as follows:—

(i) the total income and the net agricultural income shall be aggregated and the amount of income-tax shall be determined in respect of the aggregate income at the rates specified in the said Paragraph A, as if such aggregate income were the total income;

(ii) the net agricultural income shall be increased by a sum of two lakh fifty thousand rupees, and the amount of income-tax shall be determined in respect of the net agricultural income as so increased at the rates specified in the said Paragraph A, as if the net agricultural income as so increased were the total income;

(iii) the amount of income-tax determined in accordance with sub-clause (i) shall be reduced by the amount of income-tax determined in accordance with sub-clause (ii) and the sum so arrived at shall be the income-tax in respect of the total income:

Provided that in the case of every individual, being a resident in India, who is of the age of sixty years or more but less than eighty years at any time during the previous year, referred to in item (II) of Paragraph A of Part I of the First Schedule, the provisions of this sub-section shall have effect as if for the words “two lakh fifty thousand rupees”, the words “three lakh rupees” had been substituted.

Provided further that in the case of every individual, being a resident in India, who is of the age of eighty years or more at any time during the previous year, referred to in item (III) of Paragraph A of Part I of the First Schedule, the provisions of this sub-section shall have effect as if for the words “two lakh fifty thousand rupees”, the words “five lakh rupees” had been substituted.