HRA will be revised to 27%,18% and 9% w.e.f July 2021.

The Central Government has decided to increase the rate of Dearness Allowance from 17% to 28% from 1st July 2021. When DA reaches 25% level, the DA indexed allowances like HRA will also to be increased to 27%,18% and 9% w.e.f July 2021 as per the Allowance Committee recommendation.

The House rent Allowance is now paid at the rate of 24%, 16% and 8% for X,Y and Z cities.

The rates of HRA will now be revised to 27%, 18% and 9% of Basic Pay in X,Y and Z cities since the Dearness Allowance (DA) crossed 25% level.

The 7th Pay Commission initially had recommended to revise the HRA at above rates when DA reaches 50% and further to 30%, 20% and 10% of Basic Pay in X, Y and Z cities when DA crosses 100%

Then the Allowance Committee constituted by Central Government made the following changes.

The recommendations of the 7th CPC was accepted by the Allowance Committee with the following modifications:

(i) HRA shall not be less than Rs.5,400 per month, Rs.3,600 per month and Rs.1,800 per month calculated @30% of minimum pay for X (population of 50 lakh & above), 20% for Y (5 to 50 lakh) and 10% for Z (below 5 lakh) category of cities.

(ii) HRA shall be revised to 27%, 18% and 9% of Basic Pay in X,Y and Z cities when Dearness Allowance (DA) crosses 25% and further to 30%, 20% and 10% of Basic Pay in X, Y and Z cities when DA crosses 50%

Central Govt Employees in hand Salary Calculator 2021

Central Government always calculate their salary every month but when a person wants to apply for a post, he wants to know the in-hand salary every month for the level in which they will be recruited.

How to calculate the in-hand salary?

Gross Salary – Deductions = In-hand salary

The in-hand salary of the Central Government employees can be calculated using this salary calculator.

Monthly Salary Component

Basic Salary + DA+ HRA+ TA = Gross Salary

1.Basic salary for a new recruit

The first cell of the particular Level will be fixed as Basic pay to a newly recruited central government employee. [ Select the first cell in the level in which you are recruited for first year]

2.Dearness Allowance rate

Existing rate of DA [ The DA rate is 21% with effect from 1st January 2020]

3.House rent Allowance (HRA)

HRA is paid at the rate of 24%, 16% and 8% for X, Y and Z cities at present. It will be increased 27%,18% and 9% when DA reaches 25%. Like wise when DA reaches 50% the HRA Rates will be increased to 30%,20% and 10% for X, Y and Z cities resepctively.

What are all X,Y and Z cities ?

According to the population the cities are classified into X, Y and Z category cities.

The X Category Cities which which are entitled for 24% HRA

|

S.No

|

States/ Union Territories

|

Citites Classified as “X”

|

|

1

|

Andhra Pradesh/ Telangana

|

Hyderabad (UA)

|

|

2

|

Delhi

|

Delhi

(UA)

|

|

3

|

Gujarat

|

Ahmadabad (UA)

|

|

4

|

Karnataka

|

Bangalore/

Bengaluru (UA)

|

|

5

|

Maharashtra

|

Greater Mumbai (UA), Pune (UA)

|

|

6

|

Tamil

Nadu

|

Chennai

(UA)

|

|

7

|

West Bengal

|

Kolkata (UA)

|

The Y Category Cities which which are entitled for 16% HRA

|

S. No

|

States/ Union Territories

|

Citites Classified as “X”

|

|

1

|

Andhra Pradesh/ Telangana

|

Vijayawada (UA), Warangal (UA), Greater Visakhapatnam (M.Corpn),

Guntur (UA), Nellor (UA)

|

|

2

|

Assam

|

Guwahati

(UA)

|

|

3

|

Bihar

|

Patna (UA)

|

|

4

|

Chandigarh

|

Chandigarh

(UA)

|

|

5

|

Chhattisgarh

|

Durg-Bhilai Nagar (UA), Raipur (UA)

|

|

6

|

Gujarat

|

Rajkot

(UA), Jamnagar (UA), Bhavnagar (UA), Vadodara (UA), Surat (UA)

|

|

7

|

Haryana

|

Faridabad*(M.Corpn.), Gurgaon*(UA)

|

|

8

|

Jammu

& Kashmir

|

Srinagar

(UA), Jammu (UA)

|

|

9

|

Jharkhand

|

Jamshedpur (UA), Dhanbad (UA), Ranchi (UA), Bokaro Steel City (UA)

|

|

10

|

Karnataka

|

Belgaum

(UA), Hubli-Dharwad (M.Corpn.), Mangalore (UA), Mysore (UA), Gulbarga (UA)

|

|

11

|

Kerela

|

Kozhikode (UA), Kochi (UA), Thiruvanathapuram (UA), Thrissur (UA),

Malappuram (UA), Kannur (UA), Kollam (UA)

|

|

12

|

Madhya

Pradesh

|

Gwalior

(UA), Indore (UA), Bhopal (UA), Jabalpur (UA), Ujjain (M. Corpn)

|

|

13

|

Maharashtra

|

Amravati (M. Corpn.), Nagpur (UA), Aurangabad (UA), Nashik (UA),

Bhiwandi (UA), Solapur (M. Corpn), Kolhapur (UA), Vasai-Virar City (M.

Corpn.), Malegaon (UA), Nanded-Waghala (M. Corpn.), Sangli (UA)

|

|

14

|

Odisha

|

Cuttack

(UA), Bhubaneshwar (UA), Raurkela (UA)

|

|

15

|

Puducherry

|

Puducherry/ Pondicherry (UA)

|

|

16

|

Punjab

|

Amristar

(UA), Jalandhar (UA), Ludhiana (M. Corpn.)

|

|

17

|

Rajasthan

|

Bikaner (M. Corpn.), Jaipur (M. Corpn.), Jodhpur (UA), Kota (M.

Corpn.), Ajmer (UA)

|

|

18

|

Tamil

Nadu

|

Salem

(UA), Tiruppur (UA), Coimbatore (UA), Tiruchirappalli (UA), Madurai (UA),

Erode (UA)

|

|

19

|

Uttar Pradesh

|

Moradabad (M. Corpn.), Meerut (UA), Ghaziabad*(UA), Aligarh (UA),

Agra (UA), Bareilly (UA), Lucknow (UA), Kanpur (UA), Allahabad (UA),

Gorakhpur (UA), Varanasi (UA), Saharanpur (M. Corpn.), Noida*(CT), Firozabad

(NPP), Jhansi (UA)

|

|

20

|

Uttarakhand

|

Dehradun

(UA)

|

|

21

|

West Bengal

|

Asansol (UA), Siliguri (UA), Durgapur (UA)

|

All other cities which are not listed in X and Y cities are come under Z category. The rate of HRA is 8%

4.Travelling Allowance

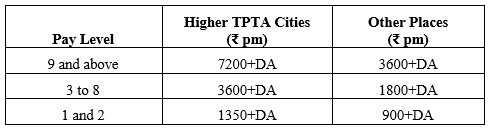

Travelling Allowance is revised in 7th Pay Commission

The 7th CPC Travelling Allowance rate is below

What are all higher TPTA Cities ?

19 Cities are classified under Higher TPTA Cities.

1. Ahmedabad (UA), 2. Bengaluru (UA), 3. Chennai (UA), 4. Coimbatore (UA), 5. Delhi (UA), 6. Ghaziabad (UA), 7. Greater Mumbai (UA), 8. Hyderabad (UA), 9. Indore (UA), 10. Jaipur (UA), 11. Kanpur (UA), 12. Kochi (UA), 13. Kolkata (UA), 14. Kozhikode (UA), 15. Lucknow (UA), 16. Nagpur (UA), 17. Patna (UA), 18. Pune (UA), 19. Surat (UA)

Deductions

Only two deductions are mandatory for CG Staffs those who are appointed on or after 1.1.2004. For those who appointed before 1.1.2004, GPF and CGEGIS are mandatory

| S.No | Appointed before 1.1.2004 | Appointed on or after 1.1.2004 |

| 1 | GPF | NPS Subscription for Tyre I Account |

| 2 | CGEGIS 1980 | CGEGIS 1980 |

[Note :Other than this, Income Tax will be deducted if Annual Income is comes under IT Bracket. Also HBA deduction will be made if House Building Advance availed. ]

1.New Pension Scheme Subscription

Central Government Employees those who are appointed on or after 1.1.2004 are covered under NPS.

The Tyre I account is mandatory for NPS subscribers. The NPS Subscription is 10 % of basic pay + DA.

10 % of the salary is deducted as subscription from the salary of the govt servants and Central Government pays 14% to subscribers account as employers contribution

2.Central government employees Group Insurance Scheme

Since the Central government employees Group Insurance Scheme is not yet revised for 7th Pay Commission regime, the old rate is continued.

The CGEGIS Rates are

- Group A = Rs.120 [ Level 10 and above]

- Group B = Rs.60 [ Level 6 to Level 9]

- Group C = Rs.30 [ Level1 to Level 5]