30/01/2025

26/01/2025

Happy 76th Republic day. It is a privilege to be born on this sacred land. Let's celebrate this day with pride and a commitment to serve our country wholeheartedly.

https://economictimes.indiatimes.com/news/new-updates/republic-day-wishes-images-2025-best-photos-whatsapp-status-fakebook-story-to-share/articleshow/117561688.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

25/01/2025

In a Gazette notification issued on January 24, it stated that the central Government has decided to introduce Unified Pension Scheme, as an option under the National Pension System for the employees of the central government who covered under the NPS.

(i) Assured Payout shall be available only in the following cases, namely: -

(a) in case of an employee superannuating after qualifying service of ten years, from the date of superannuation;

(b) in case of the Government retiring an employee under the provisions of FR 56 (j) (which is not a penalty under Central Civil Services (Classification, Control and Appeal) Rules, 1965) from the date of such retirement; and

(c) in case of voluntary retirement after a minimum qualifying service period of 25 years, from the date such employee would have superannuated, if the service period had continued to superannuation.

(ii) Assured Payout shall not be available in case of removal or dismissal from service or resignation of the employee. In such cases, the Unified Pension Scheme option shall not apply.

Benefits under the Scheme

(iii) Subject to other conditions stated in this notification, Assured Payout under the scheme shall be as follows, namely: -

(a) the rate of full assured payout will be @50% of twelve monthly average basic pay, immediately prior to superannuation. Full assured payout is payable after a minimum 25 years of qualifying service:

(b) in case of lesser qualifying service period, proportionate payout would be admissible;

(c) a minimum guaranteed payout of Rs. 10,000 per month shall be assured in case superannuation is after ten years or more of qualifying service; and

(d) in cases of voluntary retirement after a minimum 25 years of qualifying service, assured payout will commence from the date on which the employee would have superannuated, if he had continued in service.

(iv) In case of death of the payout holder after superannuation, family payout @60% of the payout admissible to the payout holder, immediately before his demise, will be assured to the legally wedded spouse (spouse legally wedded as on the date of superannuation or on the date of voluntary retirement or retirement under FR 56(j), as may be applicable).

(v) Dearness Relief will be available on the assured payout and family payout, as the case may be. The Dearness Relief will be worked out in the same manner as Dearness Allowance applicable to serving employees. Dearness Relief will be payable only when payout commences.

(vi) A lump sum payment will be allowed on superannuation @10% of monthly emoluments (basic pay + Dearness Allowance) for every completed six months of qualifying service. This lump sum payment will not affect the quantum of assured payout.

(vii)The corpus under the Unified Pension Scheme option will comprise of two funds, namely:-

(a) An individual corpus with employee contribution and matching Central Government contribution; and

(b) A pool corpus with additional Central Government contribution.

(viii)The contribution of employees will be 10% of (basic pay + Dearness Allowance). The matching Central Government contribution will also be 10% of (basic pay + Dearness Allowance). Both will be credited to each employee's individual corpus.

(ix) Central Government shall provide an additional contribution of an estimated 8.5% of (basic pay + Dearness Allowance) of all employees who have chosen the Unified Pension Scheme option, to the pool corpus on an aggregate basis. The additional contribution is for supporting assured payouts under the Unified Pension Scheme option.

(x) The employee can exercise investment choices for the individual corpus alone. Such investment choices shall be regulated by the Pension Fund Regulatory and Development Authority. A 'default pattern of investment may be defined by Pension Fund Regulatory and Development Authority from time to time. If an employee does not exercise an investment choice on individual corpus, the 'default pattern' of investment will apply.

(xi) The investment decisions for the pool corpus built through the additional Central Government contribution will solely rest with Central Government.

(xii) In respect of employees who have retired before the date of operation of Unified Pension Scheme and who opt for the Unified Pension Scheme option, Pension Fund Regulatory and Development Authority will determine the mechanism for making available the top-up amount.

Explanation: For the purpose of this notification basic pay includes non-practicing allowance granted to medical officer in lieu of private practice.

3. The existing Central Government Employees under National Pension System, on the effective date of operationalisation of the Unified Pension Scheme option, as well as the future employees of Central Government can choose to either take the Unified Pension Scheme option under the National Pension System or continue with the National Pension System without the Unified Pension Scheme option. In case an employee chooses the Unified Pension Scheme option, all its stipulations and conditions shall be deemed to have been opted for and such option once exercised, shall be final.

4. Once an employee covered under National Pension System, who is in service on the effective date of operationalisation of the Unified Pension Scheme option, exercises the Unified Pension Scheme option, the outstanding National Pension System corpus in the employees Permanent Retirement Account Number shall be transferred to the employee's individual corpus under the Unified Pension Scheme.

5. For each employee covered under National Pension System who has exercised the Unified Pension Scheme option, a 'benchmark corpus' value shall be computed, in such manner as may be determined by the Pension Fund Regulatory and Development Authority, with the following assumptions, namely: -

(i) regular receipt of applicable contributions for both the employees and the employer for each month of qualifying service;

(ii) in case of missing contributions, an appropriate value, to be determined by the Pension Fund Regulatory and Development Authority, shall be assigned; and

(iii) investment of such contributions is made as per the 'default pattern of investment, as defined by the Pension Fund Regulatory and Development Authority.

6. The value or units in the individual corpus with investment choices of the employee shall be informed to such employee on a periodic basis. Alongside, the value or units of the benchmark corpus corresponding to the employee, computed as per para 5 above will also be informed to the employee.

7. At superannuation or retirement, the qualifying service of the employee under the Unified Pension Scheme option, will be determined by the Head of Office, where he is employed.

8. At superannuation or retirement, the employee under Unified Pension Scheme shall authorise transfer of the value or units in the individual corpus to the pool corpus, equivalent to the value or units of the benchmark corpus for authorisation of Assured Payout. In case the value or units of individual corpus is less than value or units of the benchmark corpus, the employee will have an option to arrange for additional contribution to meet this gap. In case the value or units of individual corpus is more than the value or units of the benchmark corpus, the employee shall authorise transfer of value or units equivalent to the benchmark corpus and the balance amount in the individual corpus will be credited to the employee.

9. In case the values or units transferred by the employee from the individual corpus to the pool corpus, is less than the value or units of the benchmark corpus, payout proportionate to the assured payout shall be authorised.

10. The Unified Pension Scheme, being a 'fund-based pension system, relies on the regular and timely accumulation and investment of applicable contributions (from both the employee and the employer) for Assured Payout to the employees.

11. For the sake of clarity, it is made clear that any employee who has exercised the Unified Pension Scheme option under National Pension System under this notification, shall not be entitled for and cannot claim, any other policy concession, policy change, financial benefit, any parity with subsequent retirees etc. later including post- retirement.

12. The provisions of Unified Pension Scheme will also be applicable, mutatis mutandis to past retirees of National Pension System, who have superannuated before the date of operationalising of Unified Pension Scheme. Such superannuated employees will be paid arrears for the past period along with interest as per Public Provident Fund rates. The monthly top-up amount for such superannuated employees, to be determined by the Pension Fund Regulatory and Development Authority, will be paid after adjusting the withdrawals made by, and annuities paid to, them.

13. The provisions regarding assured payout under the Unified Pension Scheme option for employees facing disciplinary proceedings at the time of superannuation or where disciplinary proceedings are contemplated post- retirement, shall be separately notified.

14. Illustrative examples as to working of payouts of Unified Pension Scheme under different scenarios are given in the Annexure.

15. Pension Fund Regulatory and Development Authority may issue regulations for operationalising Unified Pension Scheme.

16. The effective date for operationalisation of the Unified Pension Scheme shall be 1ª April, 2025.

24/01/2025

Governing of PLI/RPLI Schemes under Post Office Regulations 2024.

23/01/2025

128th birth anniversary of Netaji Subhash Chandra Bose celebrated.

PLI/RPLI default fee waiver order 1.3.25 to 31.5.25

21/01/2025

Adherence to Timelines for Mail Transfer and Reporting in Case of Delays.

Post Office regulations 2024 orders... TOTAL commercial.

Previous orders/judgements of Hon'ble Tribunal/High Court/Supreme Court of India given in the favour of Department filed by Reserved Trained Pool personnel for counting of their RTP service before their regular appointment as Postal Assistant/Sorting Assistant, for purpose of various service matter.

17/01/2025

Don't accept Cable TV registation new applications acceptance.

SG FNPO letter about GDS Rule 3 and Online engagement

15/01/2025

Provision of Leave Without Allowance (LWA) beyond 180 days to the office bearers of recognized Unions of Gramin Dak Sevaks at National Level.

NC(JCM) Writes to the Hon`able Fiance Minister.

Admissibility to travel by Tejas Express, Vande Bharat Express & Humsafar Express trains under Leave Travel Concession (LTC)-reg.

11/01/2025

Postal workers across the country began a campaign to demand dignity, respect, and adequate staffing to get the job done.

RTP case letter from SG FNPO.

SG FNPO letter on Ex-servicemen fixation of Pay.

Holding of current charge of CPMG, WB Circle.

Gramin Dak Sevaks (Grant of Financial Up-gradation) Scheme, 2024- adherence to the time-schedule.

10/01/2025

Principal Bench - CAT Judgment on Advantage to contingency paid employees

Annual Sports Calendar for the year 2025 - Department of Posts

07/01/2025

Clarification in respect of creation of new category of service Association Group B (Postal &RMS)-HSG-II HSG-I and HSG-I(NFG).

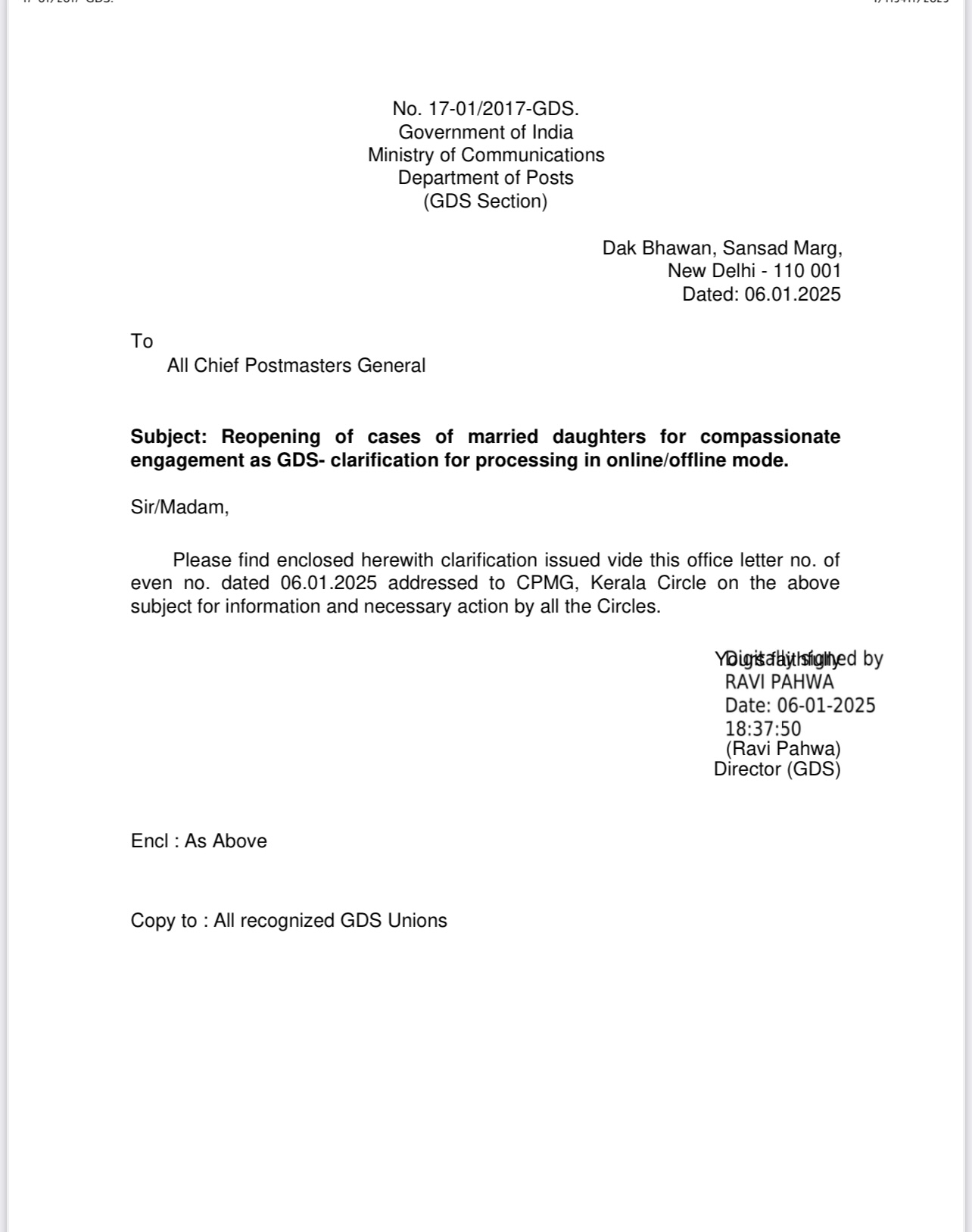

Reopening of cases of married daughters for compassionate engagement as GDS - Clarifications

05/01/2025

Dear all,

During 2.1.25 to 3.1.25 Sivaji Vasireddy, SG FNPO/GS NAPE c, Manojkumar

Kaushik, Financial Secretary NAPEc CHQ, Mahesh Kumar Sharma, GS NUR IV

met DG Post, Member (O), DDG Estt, DDG P, Director GDS/PC Cell, ADG

Tech, CPMG & DPS HQ of Delhi circle conveyed new year greetings and

discussed some issues and details like this.

1. Gr B proposed RR should be stopped and General quota should be

increased. Nothing to worry about this and a meeting will be held soon.

2. RMS merger issue all concerns of stakeholder unions will be discussed in detail on 7.1.25 meeting at Directorate.

3. Project 2.o is under active mode and very soon may be implemented.

4. Demanded to circulate the model of pay fixation case of reemployed ex-servicemen to maintain uniformity among DDOs.

5. Rule 38 for the December cycle should be released in PA/SA other

cadres like IP. (In IP cadre because of the result announcement Rule 38

allowed)

6. Assessment of POs should be conducted after finalizing regular norms based on the latest computerisation scenario.

7. Keeping in view of enhancement of counter services another 1 hour.. 5

days week, Cash arrangements, Mail schedules etc., should be

implemented.

8. Clarification about membership of RMS GDS employees..

9. GDS health insurance and gratuity issues should be finalized immediately.

10. GDS Rule 3 transfer should be carried out before the next

recruitment cycle because a large number of GDS posts have fallen vacant

due to Delhi Spl recruitment after December Rule 3 transfers.

11. Examination should be conducted for GDS recruitment instead blind merit.

12. Irregular fixing of shares and heavy penalties should be stopped in

the name of contributory negligence and DG DO letters on this should be

followed strictly.

13. Action should be taken against the responsible officials for

irregular deletion of questions in IP exam 2024 which changes the fate

of many candidates.

14. Treasury allowance for second TR/ATR and cash handling allowance for

SPMs handling cash where TR post not there issue should be resolved

soon.

15. Delhi CPMG and DPS HQ assured to look after the welfare of all who

newly joined at Delhi as Postman/MG. Nearly 900 joined and for rest 350

supplementary result including those names omitted in the first

selection list and then MTS 2022 results also going to publish. FNPO

conveyed sincere thanks for both the officers for showing much interest

in resolving the issues.

16. Along with CS NAPEc Ashok Balayan visited Lodhi Road HO/ Delhi South

DO and had interaction with the staff and postman trainers too.

17. Problems related to Postman about centralised delivery and 2 wheeler issues.

18. The cooling off period should be stopped.

%20Scheme,%202024-%20adherence%20to%20the%20time-schedule.jfif)