Travelling allowance rules after the implementation of 7th CPC

No. 904302/2018-E.IV

Government of India

Ministry of Finance

Department of Expenditure

***

Government of India

Ministry of Finance

Department of Expenditure

***

North Block, New Delhi -110001

Dated the 12th September, 2018

ToDated the 12th September, 2018

Sh. Ravi Karan

President, SSOA

A-16, Shradha Puri

Phase-II, Sardhana road

Kankar Khera, Meerut

U.P. – 250001

Sub: Clarification regarding Travelling allowance (TA) rules after the implementation of 7th CPC.

Sir,

The undersigned is directed to refer to your letter dated 25.07.2018 on the above mentioned subject. In this regard, the following is clarified:-

The undersigned is directed to refer to your letter dated 25.07.2018 on the above mentioned subject. In this regard, the following is clarified:-

(i) As per rule position as mentioned in

SR-71 of FRSR part-II TA rules, TA for a local journey shall be

admissible if the temporary place of duty is beyond 8 km from the normal

place of duty irrespective of whether the journey is performed by the

Government servant from his residence or from the normal place duty.

Further, for local journeys, a Government servant will draw, for journey

involved, mileage allowance and in addition draw 50% of daily allowance

as per OM dated 13 07.2017

(ii). After the recommendations of 7th

CPC on Allowances, OM dated 13 07.2017 regarding TA rules has been

issued by this Department wherein Daily Allowance on tour comprises 3

components i.e. Hotel accommodation, travel within the city and food

charges. For local journey beyond 8 kms, the following may be

admissible:-

a. Hotel accommodation:- Not Applicable.

b. Travel within the city/Mileage Allowance:- As per para 2 (E) (i) of OM dated 13.07.2017.

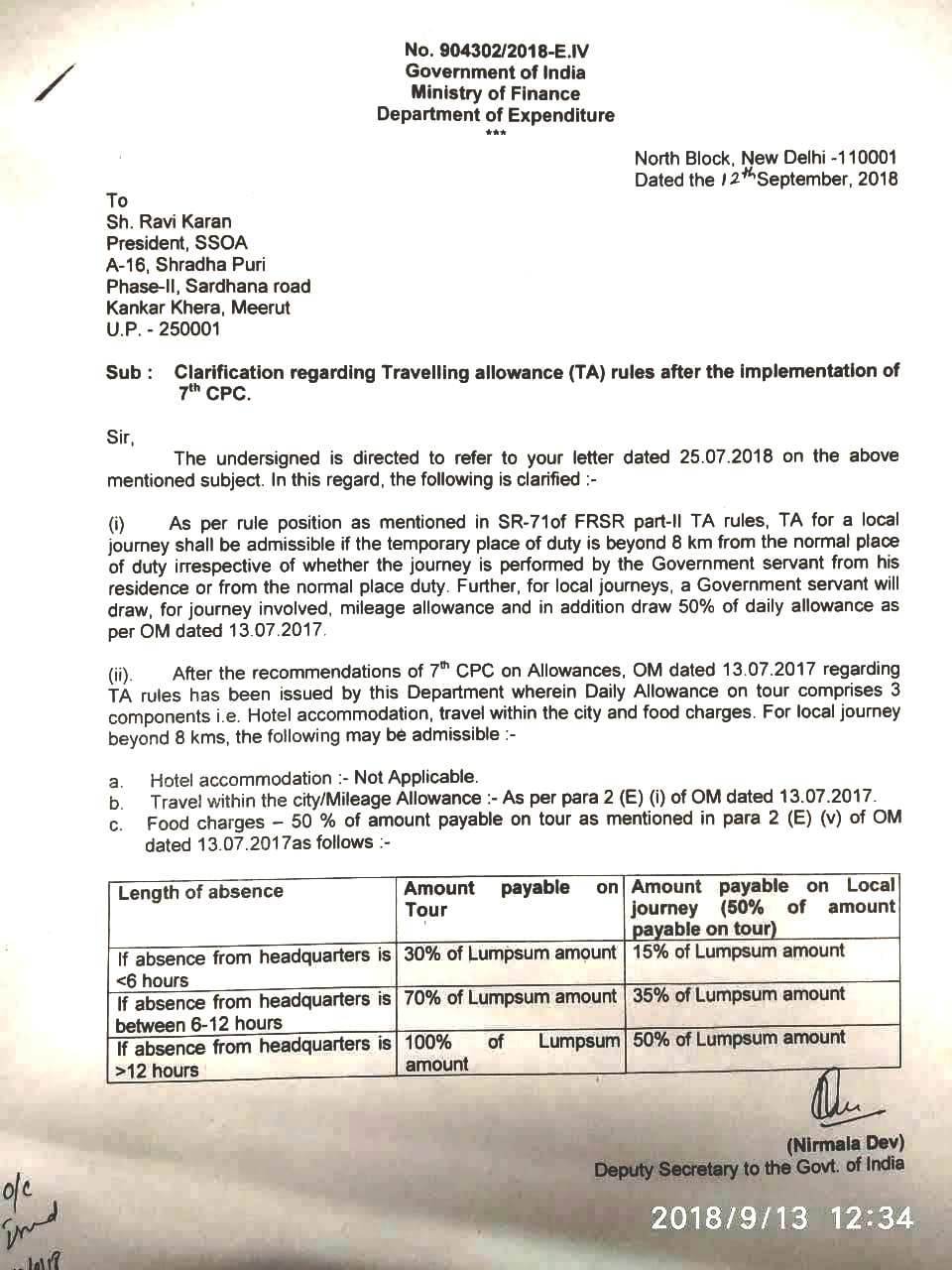

c. Food charges – 50 % of amount payable on tour as mentioned in pare 2 (E) (v) of OM dated 13.07.2017as follows:-

b. Travel within the city/Mileage Allowance:- As per para 2 (E) (i) of OM dated 13.07.2017.

c. Food charges – 50 % of amount payable on tour as mentioned in pare 2 (E) (v) of OM dated 13.07.2017as follows:-

| Length of absence | Amount payable on Tour |

Amount payable on Local journey (50% of amount payable on tour) |

|---|---|---|

| If absence from headquarters is <6 hours | 30% of Lumpsum amount | 15% of Lumpsum amount |

| If absence from headquarters is between 6-12 hours | 70% of Lumpsum amount | 35% of Lumpsum amount |

| If absence from headquarters is >12 hours |

100% of Lumpsum

amount |

50% of Lumpsum amount

|

(Nirmala Dev)

Deputy Secretary the Govt. of India

Deputy Secretary the Govt. of India